Student Housing Fund 1 (SHF1)

Financial Projections

Monthly Distributions: 10% annualized return, paid monthly beginning 60 days from investment

Capital Exposure: 60–90 days (municipal bond proceeds replace and double Fund Capital which was advanced for land purchase and pre-development expenses).

Annual Profit Distributions: 70/30 split favoring investors

Projected Average Annual Return: 100.12% over five years

Five-Year Performance:

Year 1: 23%

Year 2: 83%

Year 3: 118%

Year 4: 135%

Year 5: 149%

Total Return Multiple: 5.01X original investment over five years

Investment Structure

Minimum Investment: $100,000 (Accredited Investors only)

Total Fund Capitalization: $72,000,000

Legal Structure: Texas Limited Liability Company, Regulation D 506(c) offering

Monthly Distributions: 10% annualized return, paid monthly beginning 60 days from investment

Annual Profit Distributions: 70/30 split (70% to investors, 30% to managers)

Fund Type: Evergreen Fund—municipal bond proceeds reimburse pre-development and land costs at 2X, recycling capital indefinitely

Capital Preservation: Original investor capital remains in Fund, continually replenished through bond financing cycle

Exit Strategy: No definite exit; Fund continues developing projects until sold or Managers elect to return original capital to investors

Competitive Advantages

Exclusive Municipal Bond Financing: Only student housing developer with municipal bond access through affiliated non-profit structure

Evergreen Capital Model: Bond proceeds reimburse pre-development and land costs at 2X, recycling capital indefinitely

12-Month Lease Stability: Year-round leases eliminate summer vacancy, creating consistent monthly income

By-Bedroom Rental Strategy: Individual bedrooms rented separately reduce vacancy risk versus whole-unit leasing

20% Excess Bond Profit Margin: Projects sold at stabilized value approximately 20% above construction costs

Proven Track Record: Prairie View Phase I achieved 100% pre-leasing and successful sale to non-profit

EcoShield Integration: Proprietary building system reduces construction time and bond financing costs

Municipal Bonds Power Exceptional Returns, Zero Capital Depletion

Student Housing Fund I is the only student housing developer with access to municipal bond financing. This exclusive advantage creates an evergreen capital structure: bonds reimburse the Fund at 2X for land and pre-development costs after just 60-90 days, then fund 100% of construction. The Fund’s capital recycles indefinitely while generating 100%+ average annual returns.

Capital Preservation: All original investor capital remains in the Fund throughout the investment period, continually replenished through the municipal bond financing cycle.

Active University Pipeline

The Fund currently plans to develop the following properties:

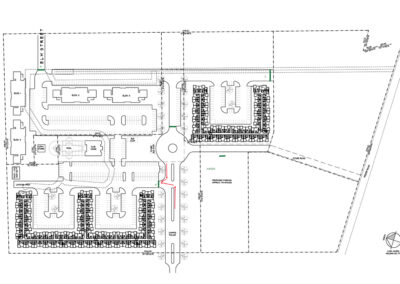

- Prairie View University Phase II (450 units) (Phase I is already completed and is 100% occupied)

- Texas State University

- Texas A&M University Central Texas (200 units)

- Tarleton State University (700 units)

- Texas A&M University Corpus Christi (300 units)

- Texas A&M University Texarkana (150 units)

- Texas A&M University College Station

- Texas A&M University Commerce

- Texas A&M University San Antonio

Note: Additional projects will be added as opportunities are developed.

Investment Features

Tax-Exempt Bond Financing: Lower interest rates (5-6%) versus conventional construction loans, reducing project costs by millions

Public-Private Partnership Structure: Leverages university financial strength to secure favorable bond terms through affiliated non-profit

Morgan Stanley Underwriter: Established relationship with premier investment bank eager to underwrite additional pipeline projects

Scholarship Housing Subsidies: University programs direct scholarship funds to housing, enhancing payment reliability and revenue security

Private Bathroom Per Bedroom: Each student has own bedroom and bathroom; shared common areas (kitchen, living room)

Premium Student Amenities: Pools, fitness centers, study rooms, and modern facilities universities cannot provide in aging dormitories

Affordable Pricing Strategy: Lower rent than conventional market-rate apartments, addressing student affordability crisis

Texas Growth Markets: Portfolio focused on fastest-growing cities over 1M population—Dallas metro rivals entire states in size

Market Opportunity

Validated Demand

Prairie View University needs 3,000 housing units; Phase I pre-leased to 100% before completion

Active Pipeline

Nine university projects spanning Texas A&M system, Texas State, Prairie View, University of Houston, and Tarleton State—totaling 2,000+ units

University Partnership Model

Texas State approval process underway with university president; land already under contract demonstrating institutional buy-in

Underserved Student Segment

International students and those on limited budgets forced to live with relatives due to unaffordable conventional apartment rates

Geographic Expansion Ready

Fund structure accommodates both public and private universities; not limited to Texas markets as model scales

Institutional Appetite

Universities actively seeking private development partners to address housing shortfalls without capital expenditure

Financial Projections

SHFI

Offering Documents

Private Placement Memorandum

Company Agreement

Subscription Booklet

Investing Instructions

Accredited Verification Form

Executive Summary

Executive Summary Download

Miscellaneous

Certificate of Formation

SHFI Portal Login

W-9